What You Need to Know

If this is at least your second cycle in crypto, you've probably noticed that there are certain periods when different types of cryptocurrencies seem to shine more than others.

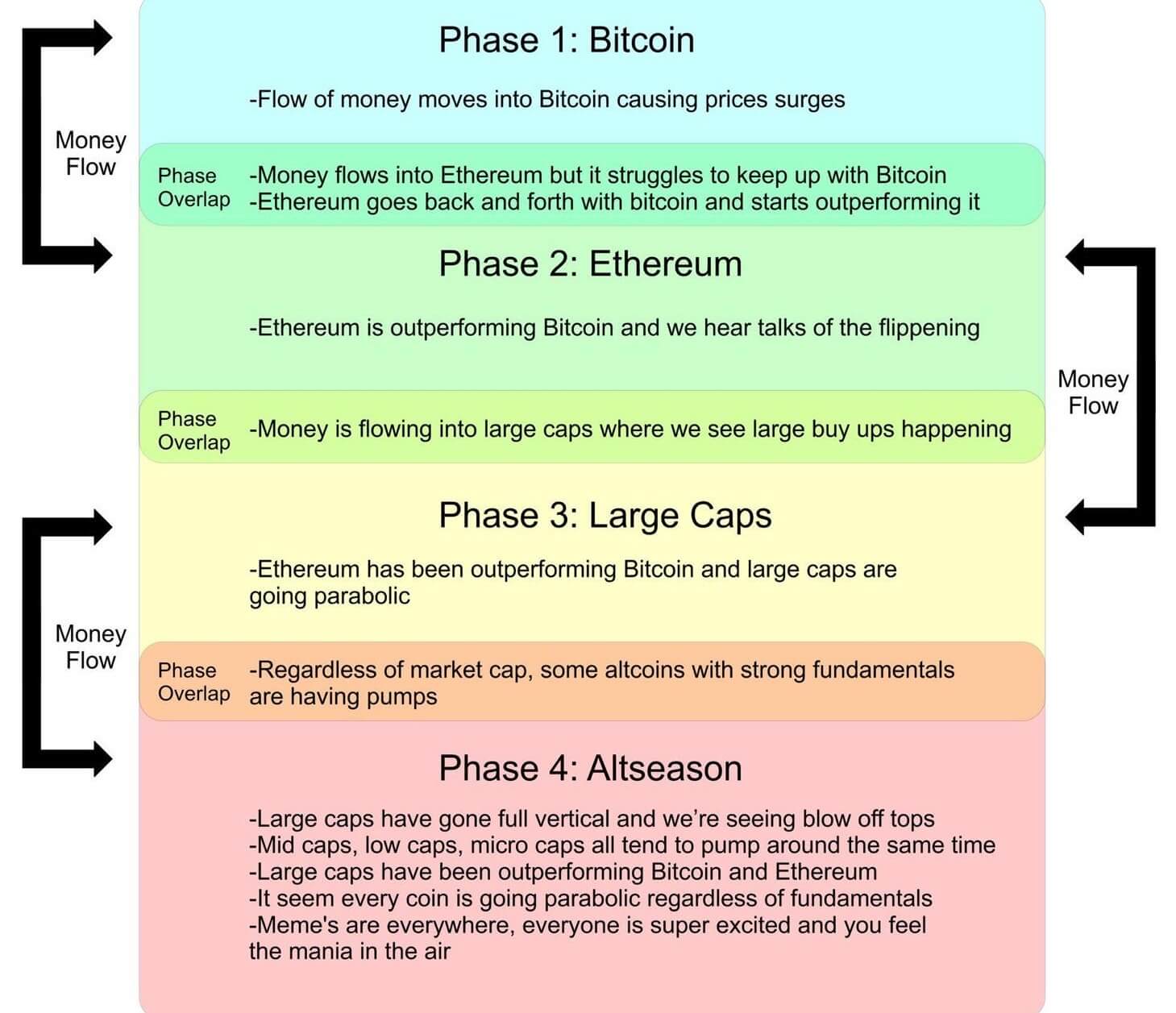

These are what we call crypto seasons, typically divided into four distinct stages within a bull market: Bitcoin Season, Ethereum Season, Altseason (which we’re all waiting for), and Meme Season. Let’s explore them together!

Bitcoin Season:

A bull market almost always kicks off with Bitcoin. In this phase, Bitcoin dominates the market, attracting most of the attention and liquidity. Both retail investors and large institutions prefer to invest in Bitcoin because it's considered the safest digital asset in the entire crypto space.

Usually, during this period, most altcoins (other cryptocurrencies besides Bitcoin and Ethereum) stagnate or even decrease in value relative to Bitcoin, as funds flow into the largest and safest cryptocurrency.

Ethereum Season:

Once Bitcoin has largely reached its growth potential in that cycle, attention shifts to Ethereum. This happens because Ethereum is the next largest cryptocurrency and is fundamental to many decentralized applications (dApps) and the decentralized finance (DeFi) ecosystem.

During Ethereum Season, the price of Ether (ETH) tends to increase significantly. Considered the locomotive of altcoins, its accelerated growth later sets the stage for the next season.

Altseason:

This is where the fun begins for investors in cryptocurrencies other than Bitcoin and Ethereum. Altseason is the period when altcoins like Solana, Avalanche, Fantom, MultiversX, and many others rapidly increase in value. People start looking for projects with high growth potential, and money flows into these lesser-known coins. In this phase, investments in altcoins can bring enormous gains, but the risks are also higher.

Meme Season:

The final phase of the bull market is often the most chaotic. In the Meme Season, coins that don’t necessarily have fundamental value, like Dogecoin or Shiba Inu, take center stage. This is the period when speculative investors and online communities drive the market, and prices can explode in a short time. Although this may seem like a fun and profitable period, it’s also one of the riskiest, as these coins can drop sharply once the wave of interest fades.

Conclusion:

Understanding the seasonality in a crypto bull market can help you better navigate this volatile market. While there are significant opportunities for profit, each season comes with its own risks. That’s why it’s essential to stay informed and have a clear strategy. And if you want to stay up to date with the latest news in crypto, stick with us. We’ll continue our series of educational newsletters.